What is FedNow® Money Services & Alias-Based Payments?

Send and Receive Payments Using a Cell Number, Email, or Alias

![]() FedNow® Money Services – Alias-Based Payments

Without a Bank Visit

FedNow® Money Services – Alias-Based Payments

Without a Bank Visit

The Future of Instant Payments Without a

Bank Visit

For decades, sending and receiving money required bank visits, physical verification, and long processing times. Traditional money service companies and banks still rely on outdated, expensive, and time-consuming methods.

Now, FedNow® Money Services disrupts this outdated model, offering instant Account-to-Account (A2A) credit transfers using alias-based payments (cell phone number, email address, or other unique identifiers). No need to visit a bank or money center—just use your online device and send money instantly.

With TodayPayments, a premier FedNow® merchant account processor, businesses and individuals can enjoy real-time transactions that are faster, cheaper, and more secure than traditional money services.

How Does FedNow® Money Services Compare to Legacy Money Providers?

FedNow® Money Services allows payments to be made without needing complex account details. Instead of requiring bank account numbers or routing numbers, users can send money using:

✅ Cell Phone Numbers –

Instantly transfer funds to any mobile-connected recipient

✅ Email Addresses – Payments linked to a

verified email for seamless transactions

✅

Custom Aliases & Monikers – Unique identifiers that protect

personal banking details

With ISO 20022 pain.001 messaging, these transactions are secure, structured, and automated, ensuring instant payer-to-payee transfers without traditional banking delays.

Ask us How:

"FedNow® Money Services with alias-based

payments using phone or email"

"How to send FedNow®

instant payments without a bank visit"

"ISO 20022

pain.001 messaging for A2A credit transactions"

"Compare

FedNow® with legacy money services"

"Real-time

alias-based money transfers using FedNow®"

FedNow® vs. Traditional Money Service Companies

Legacy money service companies, wire transfer agencies often require in-person verification, charge high fees, and have lengthy settlement times.

|

Feature |

FedNow® Money Services |

Legacy Money Service Companies |

|

Alias-Based Payments |

Yes (Email, Cell, Moniker, etc.) |

No (Requires full account details) |

|

Transaction Speed |

Instant, 24/7/365 |

1-5 days (ACH, wire, SWIFT delays) |

|

ISO 20022 pain.001 Messaging |

Yes (Structured, secure transactions) |

No (Limited data transmission capabilities) |

|

Transaction Fees |

Lower, Transparent |

High, Hidden Fees |

|

No Bank Visit Required |

Yes (Fully online transactions) |

No (Physical branch visits often required) |

|

Global Reach |

Yes |

Limited to specific networks |

Why More Businesses & Consumers are

Switching to FedNow® Money Services:

✔

No lengthy wait times – Money arrives instantly,

24/7/365

✔ No hidden fees –

Transparent, low-cost payments

✔ No need

for physical verification – Complete transactions entirely

online

How FedNow® Money Services Works for B2B, B2C, C2B & C2C Payments

Seamless Alias-Based Transactions Across All Payment Types

FedNow® enables businesses and individuals to send and receive real-time payments instantly, using alias-based payments instead of bank account details.

B2B Transactions: Pay

suppliers and vendors securely with verified email or phone-based

payments

B2C Transactions: Process

payroll, customer refunds, and business payouts instantly

C2B Transactions: Allow customers to pay

businesses instantly without entering banking details

C2C Transactions: Send money to friends, family, and

freelancers with just a phone number or email

How It Works:

✔

Step 1: The payer enters the recipient's alias (email,

phone number, or custom ID)

✔ Step 2:

The ISO 20022 pain.001 message is processed instantly

✔ Step 3: The recipient's bank identifies

the alias and credits their account immediately

✔

Step 4: A confirmation is sent, and funds are available

instantly

Security & Compliance with ISO 20022 Messaging

How FedNow® Ensures Secure & Transparent Transactions

Security and compliance are critical for digital payments. FedNow® Money Services ensures safe transactions by using:

✔ ISO 20022 Messaging –

Structured and globally standardized financial communication

✔ Multi-Layer Authentication – Verifies

alias-based payments for fraud protection

✔

Encryption & Cybersecurity – Protects transactions from

unauthorized access

✔ Regulatory Compliance

– Meets industry and financial security standards

Unlike legacy payment providers, FedNow® transactions cannot be reversed, preventing fraudulent chargebacks while ensuring faster and safer digital payments.

Accept FedNow® Alias-Based Payments with TodayPayments

The world of payments is moving towards faster, smarter, and more accessible solutions—traditional money services and are falling behind.

With

TodayPayments, a premier FedNow® merchant account processor, you can:

✔ Enable instant A2A credit payments with ISO

20022 pain.001 messaging

✔ Send & receive payments

using aliases (cell phone, email, custom IDs)

✔

Process transactions faster than legacy money service providers

✔ Lower transaction fees, eliminate chargebacks, and

improve cash flow

✔ Expand financial access beyond

traditional banking limitations

Ditch the outdated payment systems—switch to FedNow® today!

Creation Request for Payment Bank File

Enhance Your FedNow Money Services Payment Requests with FedNow’s ISO 20022 Messaging

Streamline Payments with Advanced Request for Payment Options:

Harness the power of FedNow's Request for Payment system to transform how you manage invoices and remittances. Our platform supports diverse data integration options, allowing payees to incorporate detailed invoice data directly within the RfP message or link to a comprehensive Merchant Page.

Flexible Invoice Details with ISO 20022 Messaging:

Leverage the flexibility of ISO 20022 messaging standards in our RfP system. You can choose to display crucial payment details directly in the message with a concise 140-character description, or through a dynamic "Hyper-Link" leading to a detailed Merchant Page. This Merchant Page can be hosted either on your website or TodayPayments.com/HostedPaymentPage.html through our seamless integration solution.

Customizable Merchant Pages for Enhanced Customer Experience:

Create a Merchant Page that not only details all the MIDs you own but also presents these options attractively to your customers through the RfP. This customization ensures that whether your payer opts for Real-Time Payment, Same-Day ACH, or Card transactions, they can easily navigate and complete their payments through a simple click on the hyperlink provided on your Merchant Page.

Call us today and receive the .csv or .xml FedNow® or Request for Payment (RfP) file you need—all during your very first phone call! We guarantee that our comprehensive reports integrate flawlessly with your bank or credit union. As pioneers in recognizing the benefits of RequestForPayment.com, we have stayed years ahead of our competitors. Although we are not a bank, our role as an "Accounting System" within the Open Banking ecosystem enables us to work with billers to create effective RfP files that seamlessly upload to the biller's online banking platform. U.S. companies rely on our expertise to learn how to deliver the RfP message directly to their bank with precision.

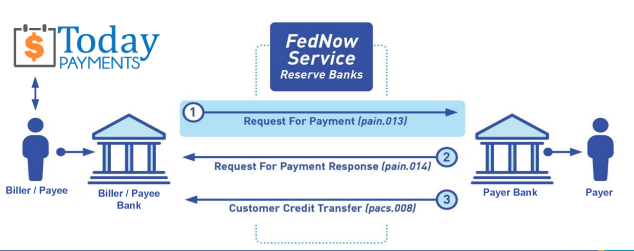

Our advanced solution, Today Payments' ISO 20022 Payment Initiation (PAIN.013), demonstrates how to create a Real-Time Payments Request for Payment file that sends a clear message from the creditor (payee) to its bank. Most financial institutions support the import of messaging and batch files for both FedNow® and Real-Time Payments (RtP), ensuring smooth processing. Once the file is correctly uploaded, the creditor’s bank processes the payment through a secure "Payment Hub"—with The Clearing House serving as the RtP Hub—and relays the message to the debtor's (payer's) bank. This streamlined approach not only accelerates transaction processing but also enhances transparency and reliability for all parties involved.

... easily create Instant Payments RfP files. No risk. Test with your bank and delete "test" files before APPROVAL on your Bank's Online Payments Platform. Today Payments is a leader in the evolution of immediate payments. We were years ahead of competitors recognizing the benefits of

Same-Day ACH and Real-Time Payments funding. Our business clients receive faster availability of funds on deposited items and instant notification of items presented for deposit all based on real-time activity. Dedicated to providing superior customer service and industry-leading technology.

Contact Us for FedNow Money Services payment processing pricing